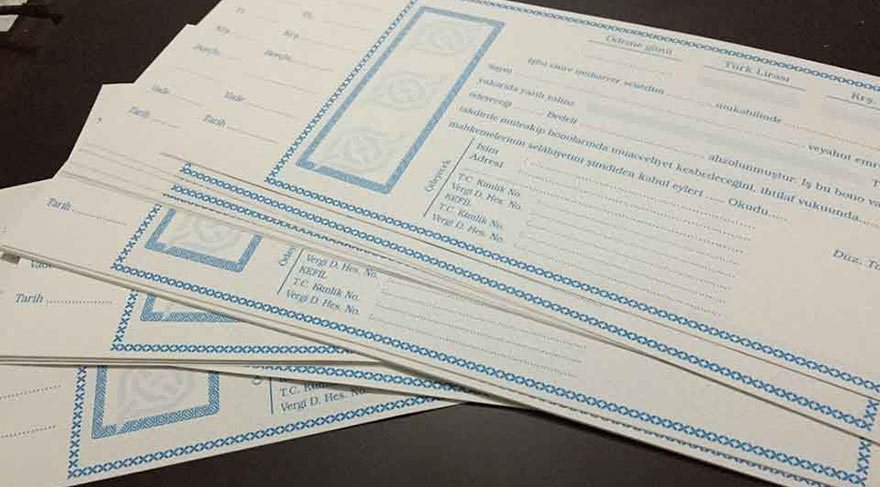

Ways to Pay Unpaid Bills

If a deed comes due and is not paid on its due date, an unpaid deed is payable. In case of non-payment of a deed, the payee may go to the way of collecting the bills of exchange in various ways. There are three different ways of collecting promissory notes from the promissory note creditor.

-Initiate enforcement proceedings,

-Drawing protests over the bank,

-The creditor’s withdrawal of warnings to the debtor,

In order to initiate enforcement proceedings, an application must be submitted to the Enforcement Office. After the application is made, the follow-up is initiated, the payee is sent a pay order and the payment is requested to be made within 10 days.

The creditor of the promissory note may, as a second way, make a protest withdrawal on the bank. In this case, the borrower enters the black list of the bank. If you are engaged in trading, when you get on the bank’s blacklist, many of your transactions also begin to go through difficult processes. Another way to collect a promissory note is to withdraw a warning from the debtor by the creditor. Paying October 10, the creditor shows good faith and gives the debtor additional time to make payments. Pay October, but if the debtor does not make or cannot make the payment within this additional period, enforcement proceedings and foreclosure path will be opened.

How are Unpaid Bills Paid to the Execution?

When the promissory note payee fails to receive his payments, he has the right to initiate enforcement proceedings. Unpaid bills In order for the execution process to be initiated, the original of the bill must be submitted by the payee to the Enforcement Office and an application must be made.

Upon the application received by the Enforcement Office, the pay order goes to the debtor. From the moment the borrower receives the pay order, there is a pay period of 10 days. If the payment is paid within these 10 days, enforcement proceedings will not be initiated.

It is essential that we state that not only the payee but also the debtor have rights regarding the collection of outstanding promissory notes. The debtor who received the paymentorder, after receiving the notification, has the right to object to the debt.

The period for objecting to the debt is 5 days after the paymentor’s order has been received by the debtor. If no objection has been made to the debt during this period, the given 10-day period continues to operate.

Is There a Time Limit for the Execution of the Deed?

The term of execution of the promissory note is 3 years. During this period, the creditor may apply to the execution in order to collect the receivable by various means. However, the applications made at the end of this period are made only as execution proceedings without notice.

In addition to the execution period of the bonds, there is also a statute of limitations. The statute of limitations for each year is different. While the statute of limitations has been determined as 10 years for the bills received from banks or official institutions, the statute of limitations has been determined as 3 years for other bills such as protested bills.